I’m a big fan of explainer books. My eclectic collection has included, over the years, books on fly-tying, hiding money in Swiss banks, creating forged identification papers, and legitimately counterfeit dictionaries. Well, I don’t own the dictionaries yet, but I’ve got dibs on them some day, a day I hope is far far away.

When I want to understand something new, there’s always the internet, but you get what you pay for. And sometimes you know so little about a topic that “googling” doesn’t do you any good. You get whatever crap someone decides to put online, even if you stick to somewhat sensibly crowd-regulated resources such as Wikipedia.

So I turn to explainer books from various sources, put out by publishers large and small. Luckily for me, people like Mary Roach and Michael Lewis are paid by publishers to write them. There are others, less well-known or published by smaller presses less interested in publishing “we all must consume constantly” narratives, but these two folks are my usual go-tos for understanding science and process or ‘self perpetuating’ capitalist machine tendencies.

As part of my research for my un-revised pandemic novel, which drew from my un-started revolution novel, I wanted to know more about crypto currency and blockchains. I’d heard about Bitcoin when it first surfaced, when it was starting to be used mildly in the “real world” and was worth several “real dollars*” each. I wanted to mine it, but was discouraged by my local hardware/software expert. I was also chasing around young kids, so I didn’t have the brain space to ever set up a mining rig.

But I wanted to use a blockchain currency in my novel(s). So I needed to learn more, not just pick up snippets from reading about general modern economics. I worked for a pair of crypto wallet companies for a while, and got the transaction side of basics down, but it still wasn’t enough. I got my pandemic novel written, but left the blockchain currency bits in the outline for book three, only setting up the ground work in books one and two.

I’ve also recently finished Michael Lewis’ The Premonition: A Pandemic Story, and it was pretty good. I had it in mind to see what, if anything, the author of Moneyball, Liar’s Poker, The Big Short, and Flash Boys had to say about it at some point in the future. Turns out Michael Lewis is writing about it*, as of late, and at the time my next read was being written he was likely still believing it was a pretty legit industry and not completely about fake money.

That tidbit is from that next read: Easy Money: Crypto Currency, Casino Capitalism, and the Golden Age of Fraud (non affiliate link). It’s hilarious and chatty, and content wise, a well written book. I heard an interview with Ben McKenzie about his collaboration with financial writer Jacob Silverman on it, and picked it up release day.

I listened to the audio edition which has some issues, but something struck me after a further garble in Chapter 11/12: the USA based oligarchs (a number of whom are part of the Union of Assholes and owned lock stock and barrel by no-goodniks out of the country) are applying “buy out the problem” to knowledge and art.

Buying out the problem is old hat in the business world. Build a company, notice a competitor, drive them out of business or near enough, then buy them out cheap. See also Wal-mart. With the “tech revolution” of my young professional years, this moved to software companies, too. Buy out a competitor just for their customer list, or their patents, then slowly shut it all down as the SLAs expire along with the contracts. Or reinvent your company, shedding the old customers you don’t want, “re-signing” the new ones at higher rates because only you can solve the problems in your own software.

Now it’s content. In the ollllllllllllllld days (up through the 90s), TV shows and movies (and contracts) were written with syndication payments included. Eventually home movie (BetaMax, VHS, VideoDisc, Laser Disc, and DVD) sales. But the execs learned, and refused to negotiate in improved rates or decent rates for streaming profits. That and AI, which I’ll cover another time, is at the heart of the current writer’s strike. HBO is pulling content, Paramount has pulled content, and others like Disney are continuing to wreak havoc, too. It’s never to be seen again, unless we bake it into our contracts — should it get pulled or go out of “release” (for books, it’s fall below a specific threshold of sales) — we get our stuff back.

But that’s not what I realised from Easy Money. Ben was going on about how this crypto fraudster was taunting that crypto fraudster and “liking things” and “deleting tweets” and how other intrepid investigators went through content in harder to see platforms like instagram and other closed platforms.

I remember those days, before APIs were more available, scraping RSS feeds, working with some friends to figure out why people were lying on the internet. (Bored people stealing photos and spinning stories for financial gain.) We didn’t have “google image search”, we just had to weed through everything to pick it out and then mega post on whatever message board ecosystems they were scamming.

But with twitter restricting API access (and Reddit), USA based oligarch Musk isn’t just suppressing people his investors (the bone saw wielding types) prefer not to have access to open communications. Straight up academic researchers are shut out, hobbyist data collectors are SOL, and they’re effectively shutting down investigations of fraud, too. If Ben had tried to write this book a year later, or Musk at the behest of the investors he’s beholden to had gotten Twitter and shut off the APIs sooner, much of this information would have been ruinously expensive to gather, if it could have been gathered at all.

Maybe Wikipedia needs to start a twitter clone. Technobros Jack Dorsey and Mark Zuckerberg and the relatively quiet Peter Thiel have already proven they can’t be trusted to run things. Considering what it takes to become a mega millionaire or billionaire, no one really qualifies. Though the Wikipedia model of policing by group consensus in some ways won’t necessarily flex to fit a new Twitter fast enough. The problems are always faster than the solutions.

- Real dollars – all money is fake, a shared delusion we share to get stuff done. It also allows the local Oligarchs to pull all kinds of bullshit shenanigans on us to get more of this fake stuff and give us less … but that’s a whole other ball game.

- Crypto is just … faker. Ben and Jacob’s allusion to The Emperor’s New Clothes is very apt.

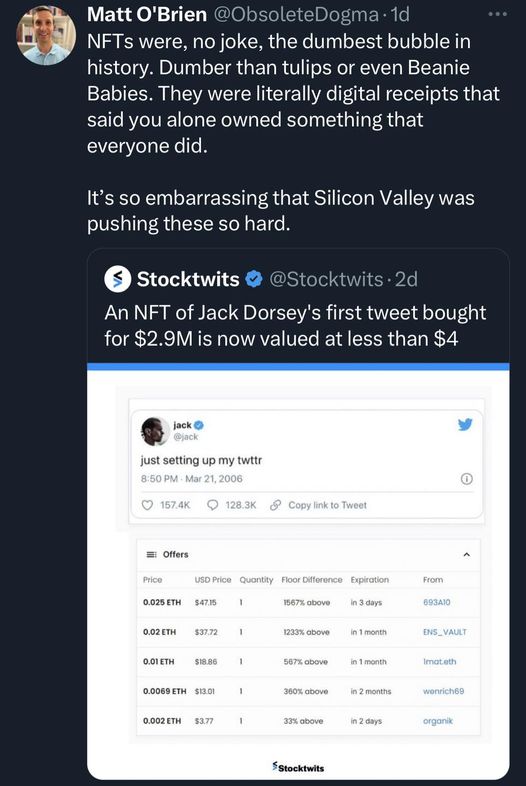

- And NFTs … well: https://twitter.com/obsoletedogma/status/1682845832368857093

Source: https://www.facebook.com/catsacab/posts/pfbid02fi18pYZWBVWFzPT5GGhSfNokiCtw4BKMf7qn2r8oN7vpwPsW2taoLTwJL6spqTpAl

*Michael Lewis is writing about [cryptocurrency]:

You were following him [Sam Bankman-Fried] closely before his legal troubles started. When did you first get the sense that his business was in trouble and possibly fraudulent?

I would rather not answer that question. I want the reader to experience surprise when reading it. My own experience will be part of the surprise. In October, there’s probably going to be a trial, and the two sides are each going to take a bunch of facts and tell completely different stories. I think I can tell a story that’s a better story than either side, that includes all the facts and will put the reader in a position of being the juror.

https://www.nytimes.com/2023/05/16/books/michael-lewis-ftx-bankman-fried-going-infinite.html